The only provider designed specifically,

for service-based small businesses!

ThryvPay™ helps you get paid faster and easier and get credit with contactless payments. Safe and secure with next day funding.

Thryv™ lets you book, invoice and get paid all from one software.

Accept, Track & Process Payments with:

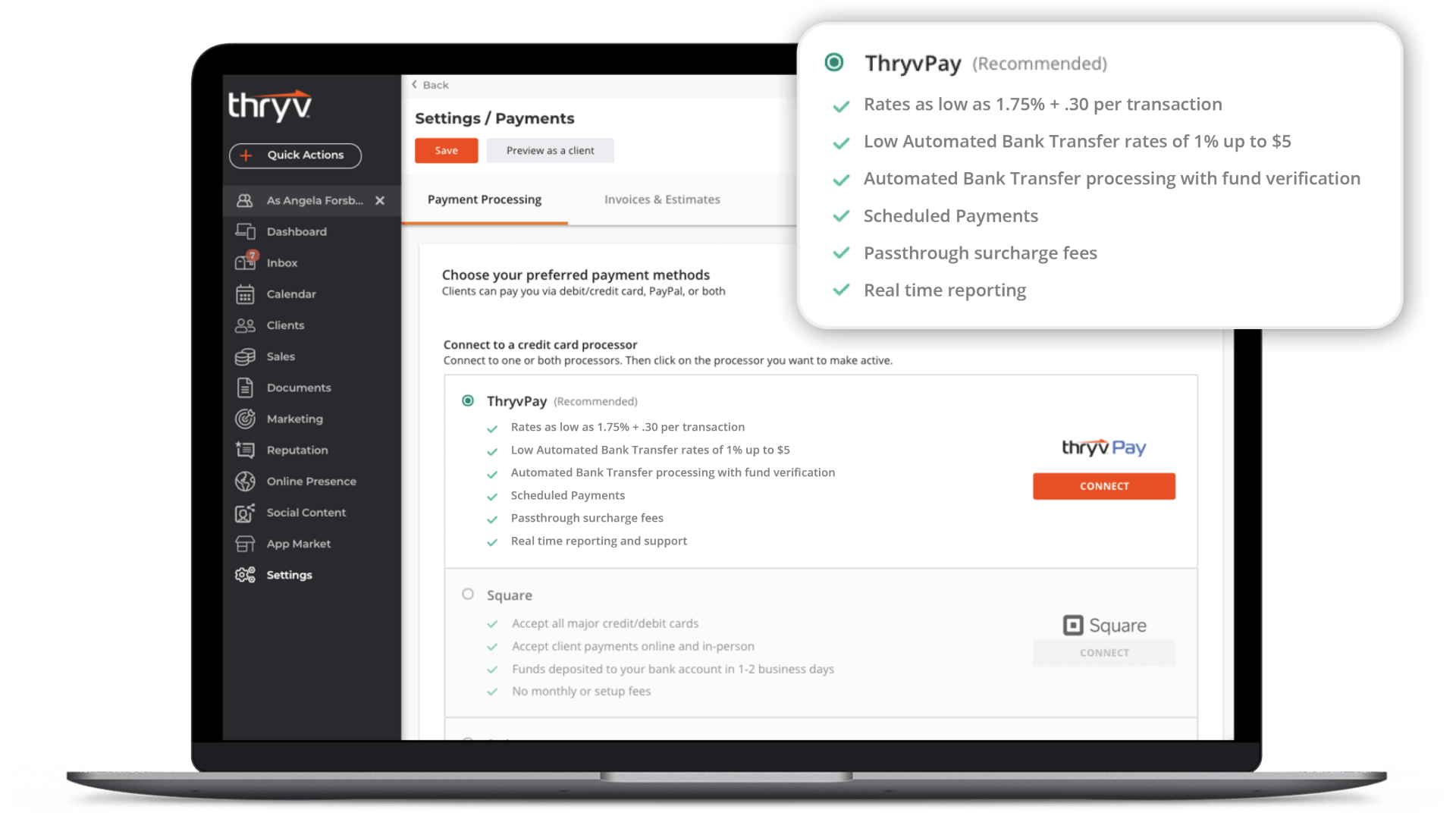

Competitive Credit Card Processing Rates

Competitive flat rates eliminate the guesswork out of your processing costs.

Rates as low as 1.75% +$0.30 per transaction.¹

No set up fees. Safe and secure credit card processing.

- Save money with lower rates and transaction charges by determining best payment option with every transaction.

- Next day funding and peace of mind means you never have to wait for funds.

- Contactless payments offer safe and fast cashflow solutions with Credit Card, Apple Pay and Google Pay payment options.

- No limits.

Accept all major credit cards makes online transactions and payments convenient for customers.

ThryvPay includes easier checkout for customers with Wallet Pay!

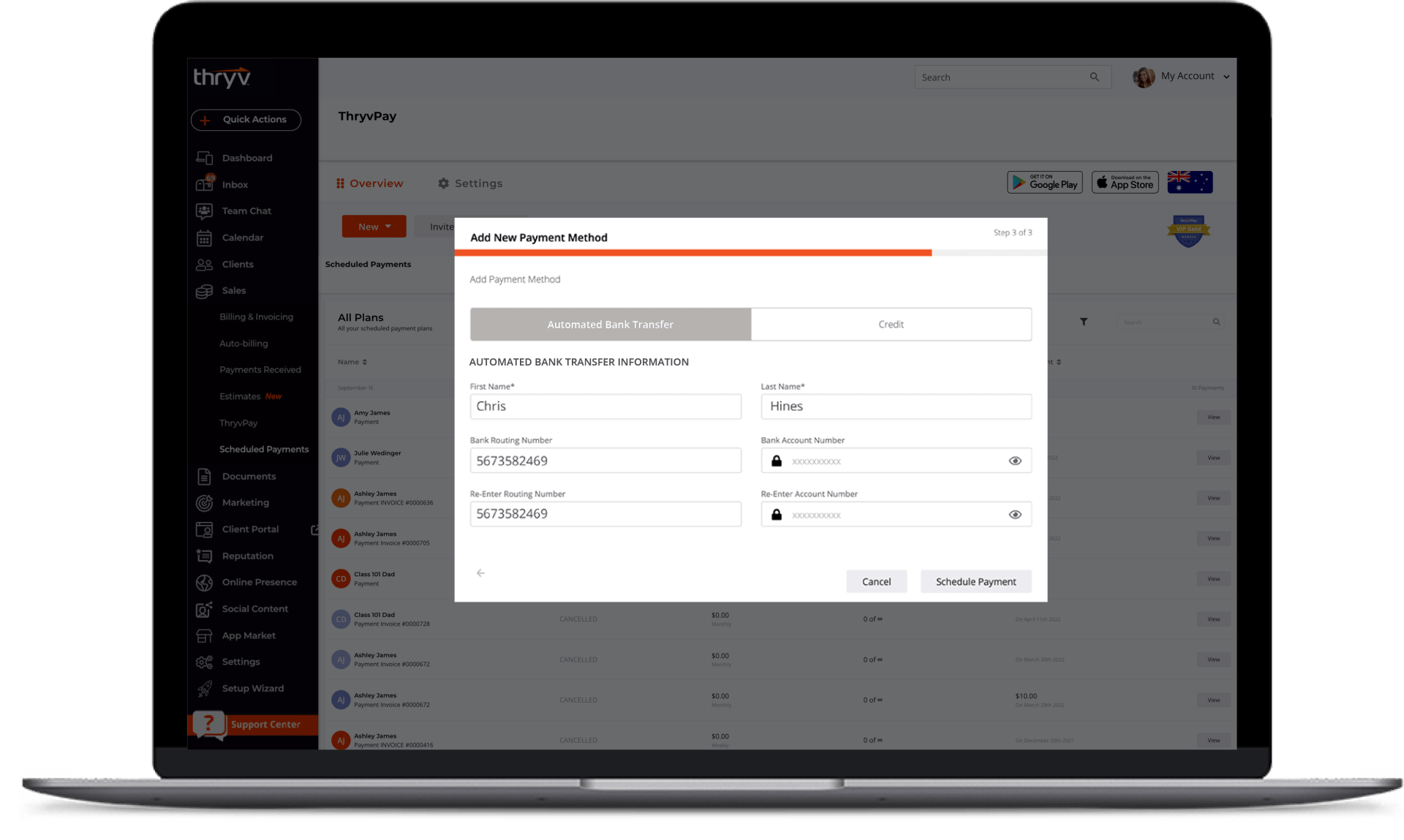

Automated Bank Transfers

Gain confidence with every transaction with contactless electronic payments that get you paid faster.

Automated Bank Transfer transactions include account and funds verification, saving you time, fees and extended funding!

We validate when your customers make a purchase, ensuring the correct account information and they indeed have the funds available for the purchase.

- Have confidence knowing customers have money in their account when accepting bank payments.

- Minimize high credit card rates with Automated Bank Transfers, so you never pay more than $5 per transactions over $900.

- Automated Bank Transfer rates

of 1%, up to $5.00 per transaction. Minimum of $1 per transaction.

- Get funds faster and in your account, processing can be up to 7-10 business days.

Did you know?

66%

of consumers are likely to use an electronic, bank-to-bank (Automated Bank Transfer) transfer

to pay a service provider

if available.²

Scheduled Payments

Generate recurring revenue and minimize late or missed payments with Scheduled Payments.

Setting up and customizing scheduled payments is easy and offers your customers flexibility so they can pay with convenience, while building customer loyalty. With features like credit card or bank on file, it creates a secure catalog in Thryv’s CRM for ease of future payments and automatic billing.

Recurring Payments

- Automatically charge customers the same amount every year, quarter, month, week or even day.

Installment Plans

- Allow your customers to make payment installments over time. Or use installments to allow for deposits.

Memberships

- Manage and track membership billing with detailed reporting.

Surcharge Fees & Tipping

Offset credit card processing fees by applying a 1.75% surcharge fee and generate revenue faster with credit card payments.

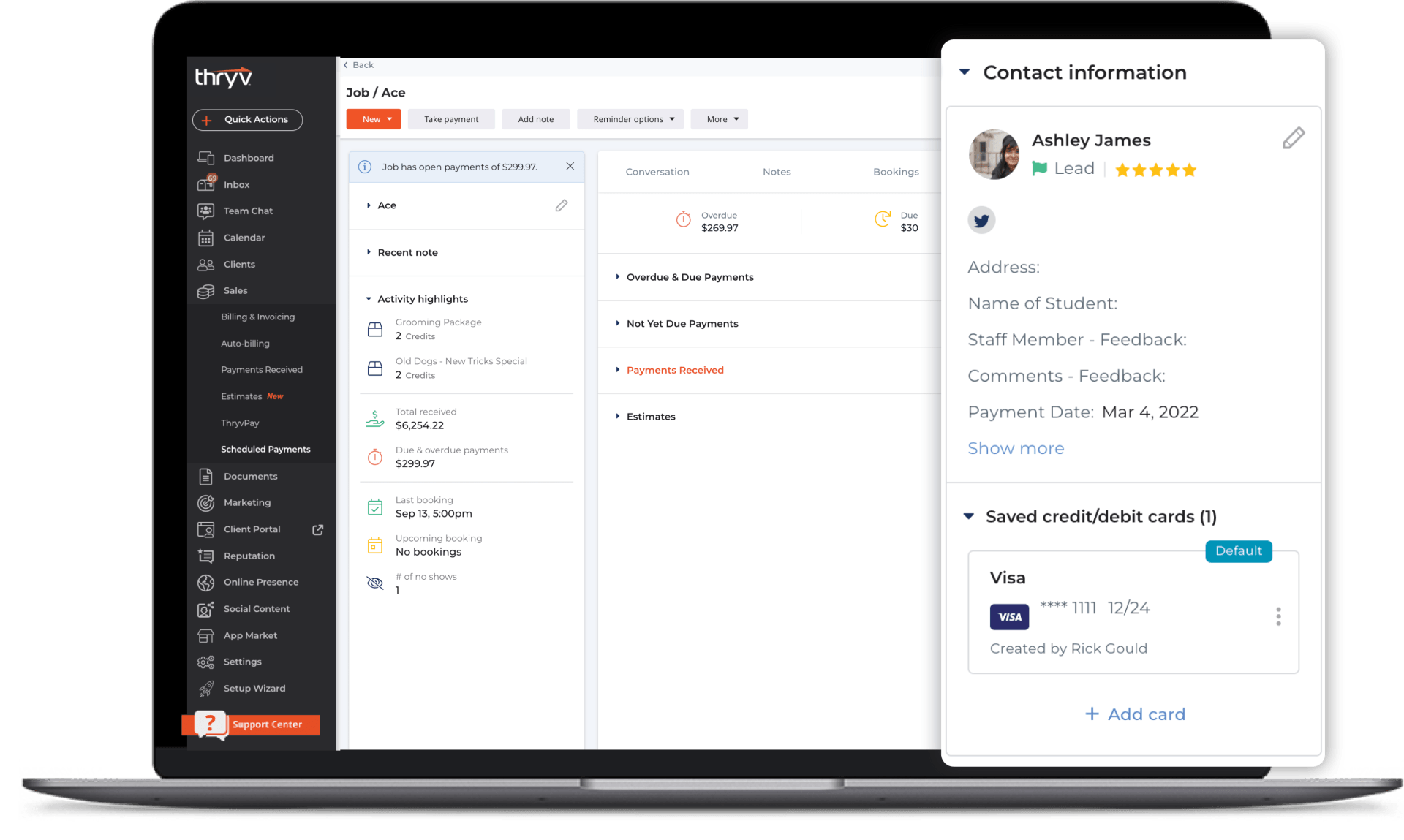

Card on File

Save your customer's credit card and bank account information for faster future purchases, safe and secure.

Card on file makes it easy and convenient for returning customers to pay and for you to set up recurring payments.

Located in the CRM Client Card, you can save and store Credit Card information into the vault, when charging a transaction in the platform. Easily manage, edit, remove or determine "default" card. All sensitive card data is encrypted and stored with your Payment Processor's secure servers, never in Thryv!

Did you know?

73%

of consumers say the type of payment options available

will influence their final decision.²

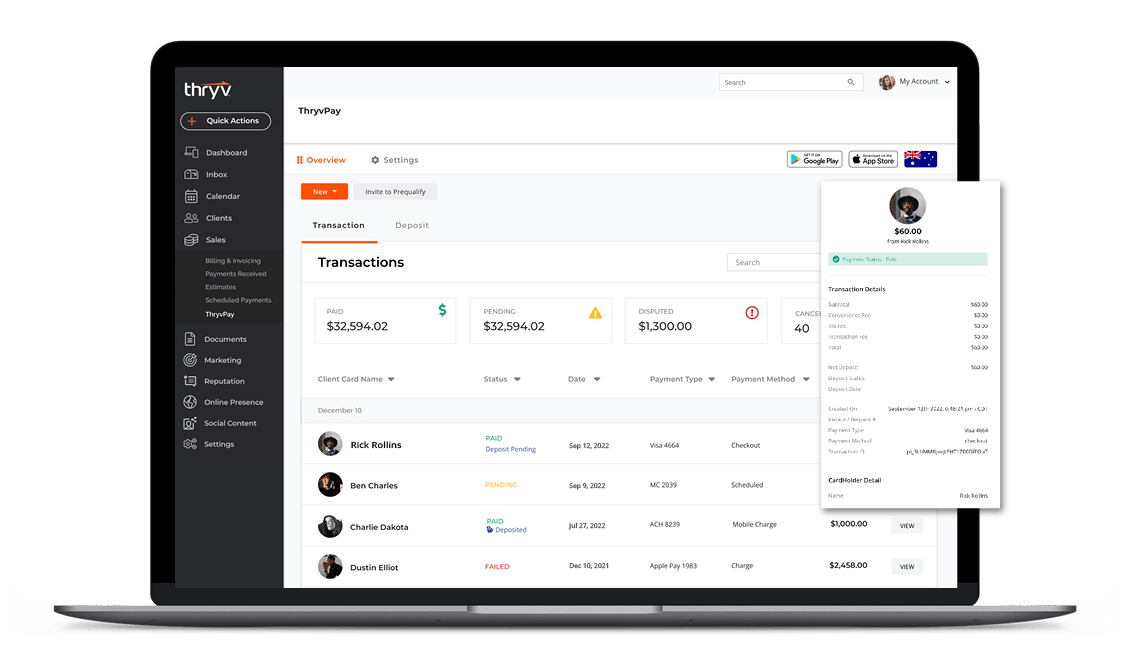

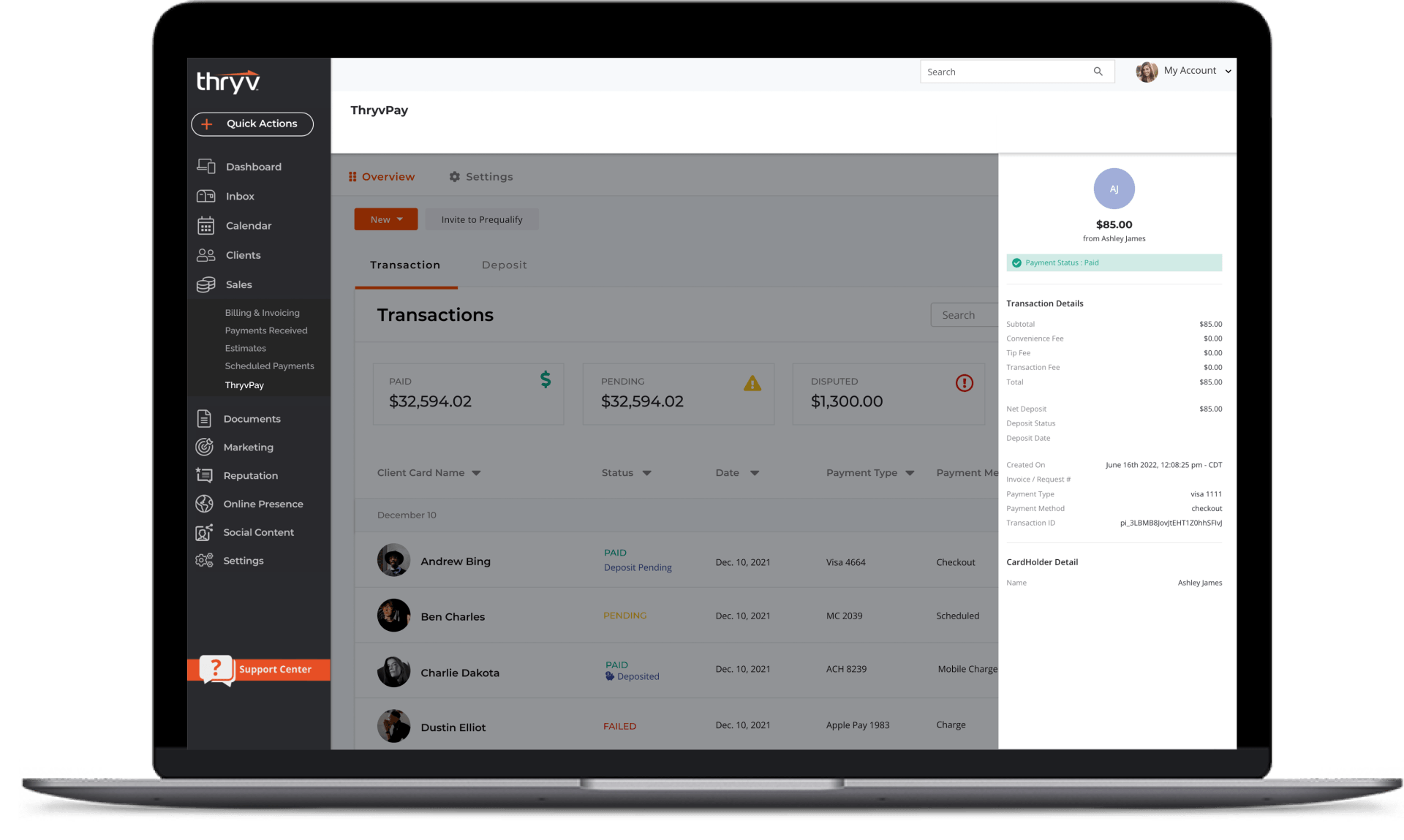

Real-Time Reporting

Spend less time reconciling with real-time reporting. Track and manage your transaction fees, payments and deposits directly inside Thryv.

Reporting accessible when you need it so you always know what's scheduled, pending or overdue, anytime.

- Real-time full reporting on every transaction shows every fee and status.

- Easy reconciliation with automatic syncing via QuickBooks.

- 24/7 snapshot

lets you view status of your funds at any time, on any device.

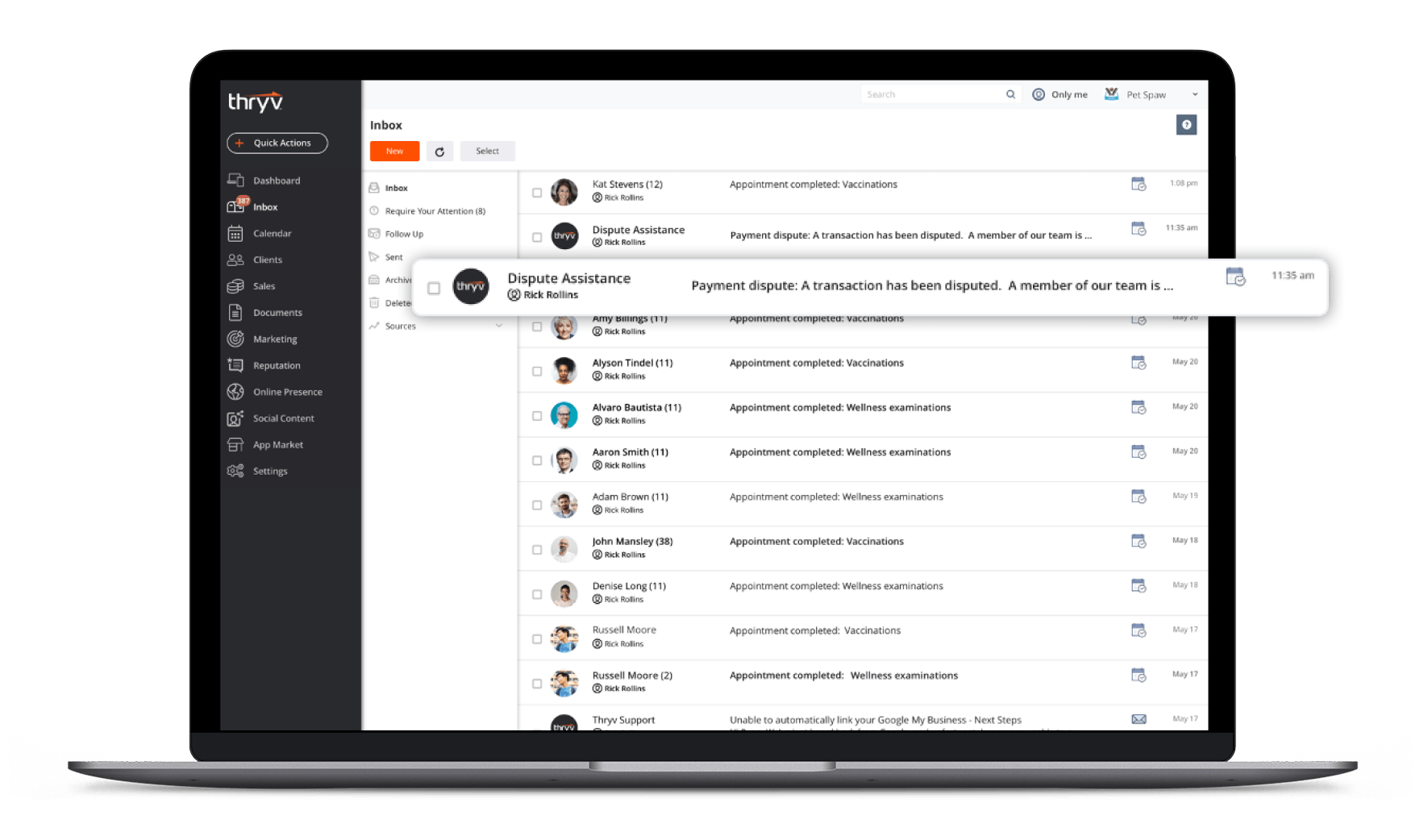

Support & Dispute Assistance

ThryvPay includes a dedicated support team ready to assist with those detailed payment questions, disputes and chargebacks!

ThryvPay Support saves you time and the hassle from identifying and managing those chargebacks and disputes.

ThryvPay Support Dispute Assistance includes:

- Application status and questions, transaction level questions including funding and deposits.

- Helps determine if you want to challenge or accept a dispute.

- Assists with gathering and submitting

documentation to fight and dispute those pesky chargebacks.

ThryvPay Mobile App

The only payment provider designed specifically for service-based small businesses!